Climate-Positive Development Is the Smartest Money on the Table

For years, sustainability was framed as a moral surcharge—something that “felt good” but diluted returns. That narrative is obsolete. Across construction, tourism, and infrastructure, the data now show a straight economic case: every dollar that mitigates climate risk or restores a biome comes back with a multiplier, both immediately and over the asset’s life.

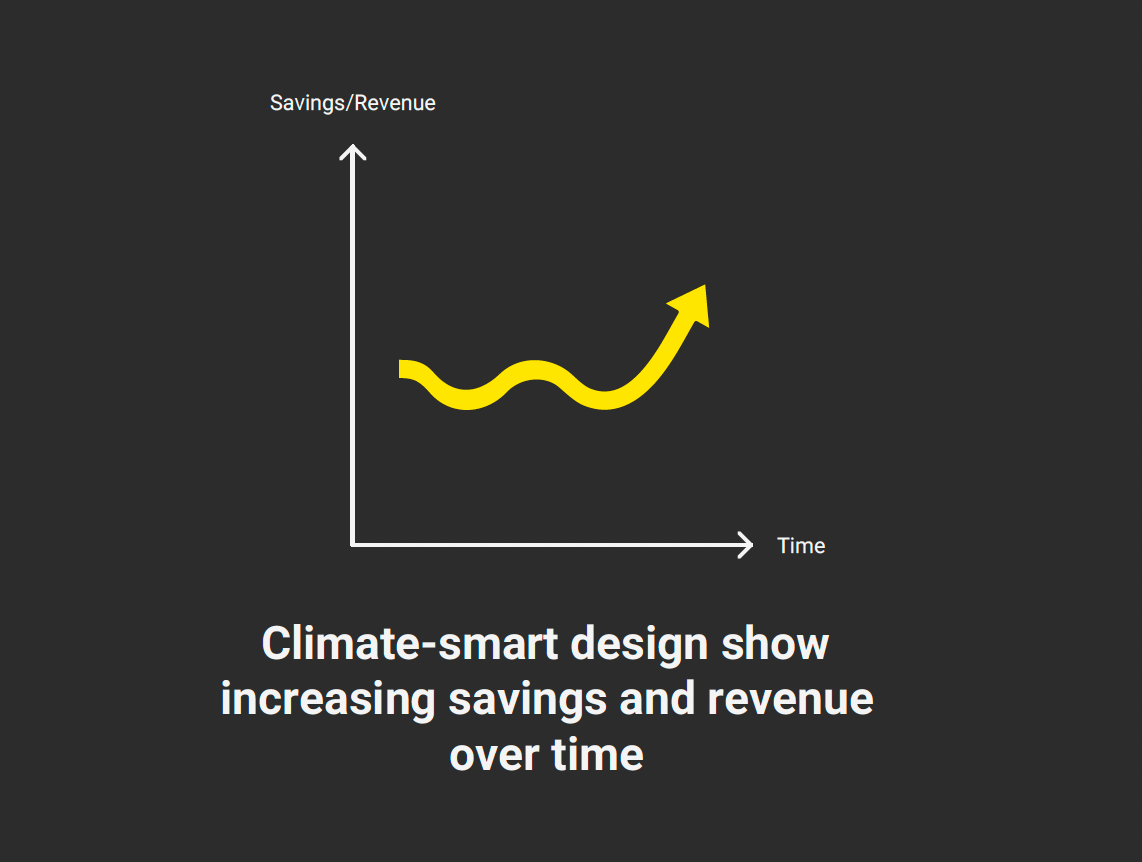

Fast paybacks from climate-smart design

- High-performance buildings that capture rainwater, recycle greywater, and generate on-site solar power are no longer boutique experiments. Field data from large clusters of certified green projects report 40–50 % cuts in energy use and 30–35 % less water consumption, shrinking utility bills enough to recoup the typical 2–3% construction premium in as little as 18 months.

- Those operating savings translate into price power: certified properties command 3-4 % higher rents and significantly higher occupancy—a revenue uplift that compounds year after year.

- Even deeper “living-building” upgrades—solar canopies, biomass digesters, living roofs—show pragmatic paybacks. One recent multi-year case study clocked an

8.5-year return on solar alone, after which the panels print pure margin.

Climate adaptation turns pennies into dollars

Macro-level cost–benefit work is even clearer: investing

$1 in climate resilience can yield more than $10 in avoided losses and new productivity within a decade. That ratio outperforms many conventional asset classes and dramatically lowers insurance exposure.

Regenerative tourism widens the profit spread

In visitor economies, shifting from “do no harm” to active ecosystem repair actually raises margins. Destination plans built around habitat restoration and community co-management report a

higher economic margin per visitor than traditional mass-tourism models, thanks to longer stays, premium pricing, and repeat visitation driven by authentic environmental narratives.

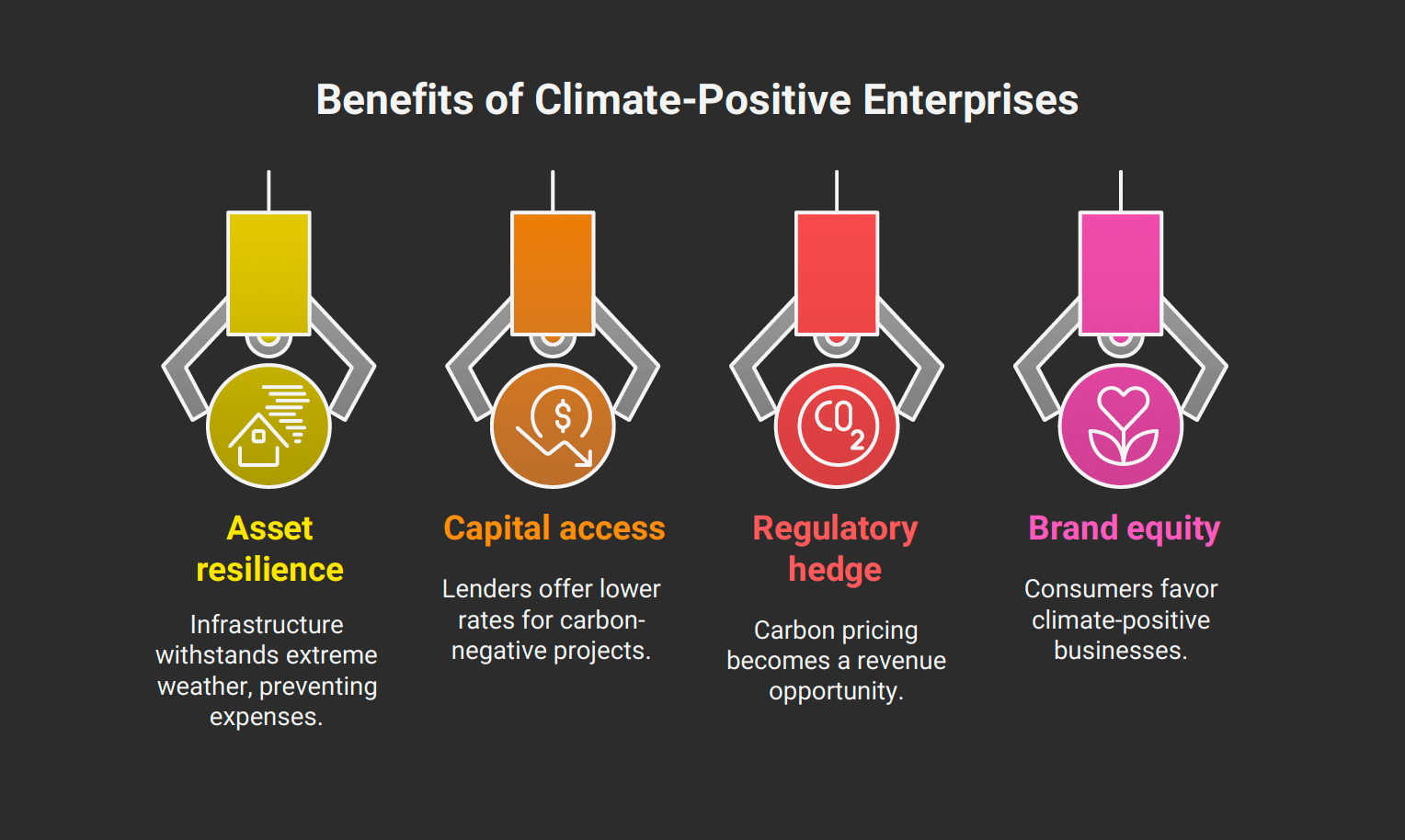

Compounded long-term upside

- Asset resilience: Infrastructure designed for extreme weather avoids costly retrofits and downtime.

- Capital access: lenders now discount rates for verifiable carbon-negative or adaptation-aligned projects.

- Regulatory hedge: future carbon pricing or water-stress rules become revenue opportunities instead of liabilities when an asset already produces surplus energy or captures its own water.

- Brand equity: Consumers and talent gravitate toward climate-positive enterprises, reducing acquisition costs on both fronts.

Bottom line

Climate mitigation and biome regeneration are no longer philanthropic side quests; they are high-performance investment strategies. The short-term gains—utility savings, rent premiums, margin per visitor—arrive quickly, while the long-term dividends—risk insulation, lower cost of capital, brand durability—keep compounding. In a world where unmanaged climate risk is the most expensive liability, the smartest capital is the capital that heals the planet while it grows.